By: Ben Potter

Developers of new gas plants on the east coast have every right to be envious of their counterparts in Western Australia.

Strike Energy last month took a final investment decision (FID) on a $137 million investment in an 85-megawatt gas peaking plant at its South Erregulla gas field north of Perth. (Peaking plants or “peakers” run infrequently and capitalise on price spikes during supply squeezes.)

Its commitment was eased by WA’s plan to retire its last coal power station in 2030, and concessions from the Australian Energy Market Operator. AEMO bumped an annual “capacity payment” in WA’s Wholesale Electricity Market – which supplies the South West Interconnected System (SWIS) -- up to as much as $354,000 per MW, and the WEM’s price cap by 54 per cent to $ 1100 per megawatt hour.

Gas peakers will be increasingly relied on to smooth out the ups and downs of wind and solar generation as coal power stations shut down, but AEMO is also warning of an increased risk of gas shortages in the coming years as Victoria’s Bass Strait fields wind down and new fields are slow to open up.

Strike CEO Stuart Nicholls reckons the changes to WA’s WEM settings boosted the plant’s projected capacity utilisation to more than 30 per cent from 18.8 per cent, and its internal rate of return to 27 per cent. He is counting on increasing demand for gas generation, especially peaking power, from electrification and coal retirements, to smooth the ups and downs of wind and solar.

“While delays in the Government’s coal phase-out plans present a potential risk, we anticipate a substantial increase in electricity demand driven by increased electrification and the expansion of energy-intensive industries in parallel,” Nicholls says.

“This opportunity allows Strike to maximise the revenue generation from every gigajoule of its valuable and limited gas resources.”

East coast ambivalence

Gas power developers in the East Coast National Electricity Market’s largest states receive no such capacity payments (some sort of capacity market will be considered by the NEM review headed by Tim Nelson, according to Marsden Jacob Associate’s Cameron O’Reilly in an Energy Policy Institute of Australia paper). But they can earn much higher peak prices in the NEM during supply squeezes – as much as $17,500/MW (a not infrequent occurrence in the volatile NEM, seen in NSW in November).

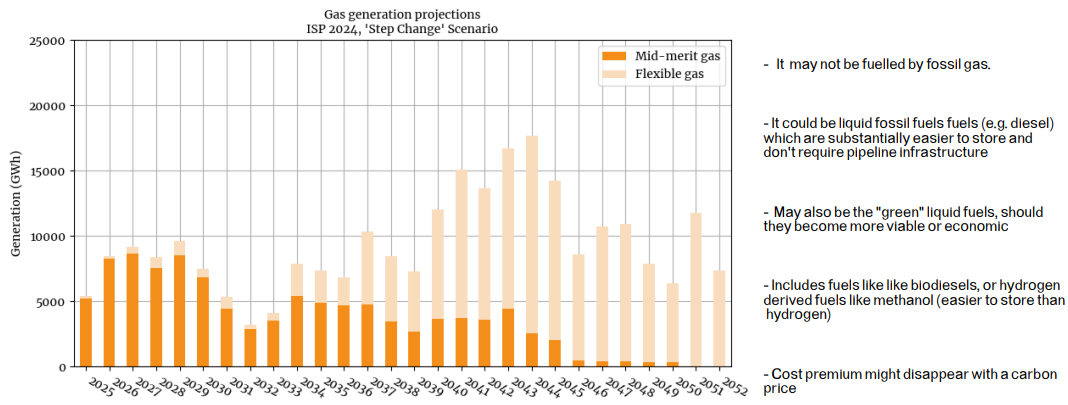

As a result -- and despite the enthusiasm of the gas industry -- FIDs on new gas peakers are at something of a stalemate. AEMO’s Integrated System Plan 2024 projections for the NEM require an increase in gas generation capacity from 12.5 gigawatt today to 13.5 GW in 2024-2025 and 17 GW-18 GW in the early 2040s, virtually all firming or peaking. But generation declines from 10 terawatt hours today to 3 TWh-7 TWh in the early 2030s before surging to 16 TWh-17 TWh in the early 2040s.

Consultancy Rystad says AEMO has “consistently underestimated gas generation”; its own projections are for a big jump through to the early 2030s.

These projections are contestable in the longer term. University of NSW senior energy researcher Dylan McConnell says by the time increased gas capacity is needed, “green” liquid fuels such as methanol may be available in sufficient quantities to displace fossil gas. (Liquid fuels can be transported and stored like petroleum and used to fuel modern gas peakers.)

That’s a distant prospect now, but in time it could undermine the viability of gas pipeline networks, whose owners are already raising the spectre of electrification and “gas substitution” policies in regulatory filings seeking tariff hikes (while talking up “renewable gas” in their public advocacy).

Meanwhile, the current projections still leave new plants reliant on high peak prices in the NEM to repay their capital.

Beach Energy CEO Brett Woods says “market reforms” are needed to support existing gas generators and bring new generators into the market. Beach is mulling plans for 50 MW-120 MW of gas peaking generation in Victoria offshore from the Otway and Bass coasts, but decisions are at least 12 months away.

“We are seeing this already in the SA market with the concept around the Firm Energy Reliability Mechanism, which introduces a cap-collar based revenue support mechanism,” Woods says.

“We anticipate that a similar concept or mechanism will need to be introduced in other States linked to the NEM.”

AEMO lists another nine gas peakers that are announced but not committed, from heavyweights Squadron Energy (owned by Andrew Forrest), Origin, AGL, APA Group and Quinbrook, alongside Snowy Hydro’s committed 750 MW Kurri-Kurri gas plant and EnergyAustralia’s just commissioned 320 MW Tallawarra B.

Origin CEO Frank Calabria is among those calling for market mechanisms over and above the NEM’s “energy only” payments to support gas firming investments, while Squadron CEO Rob Wheals and AGL CEO Damien Nicks have backed a role for gas generation in the NEM.

Future role of gas

[Source: AEMO ISP 2024/Dylan McConnell UNSW]

Gas shortages

AEMO warned this year that a supply gap could open up in southern states from 2028 without new supply, with small seasonal supply gaps on the cards from 2026. The expected increase in future gas demand for electricity generation, and the difficulty in getting new gas fields into production, is exacerbating these fears.

There are offsetting factors. Residential and industrial gas users -- which are being encouraged to electrify and reduce their carbon emissions -- may use less gas in future. Electric appliances such as heat pumps are getting better and more efficient, and may supplant more gas for industrial heating than currently expected, says Dani Alexander, CEO of the University of NSW Energy Institute. “That … expands the opportunity for electrification, in say, manufacturing,” Alexander says. New fuels – such as biodiesel and green methanol may also replace fossil gas in some modern peaking plants in future, says UNSW’s McConnell. “It’s not a huge marginal impact in the short term, certainly. Then in the longer term, it's got some competitors,” McConnell says.

Still, energy market planners must plan for the worst.

Join us at ADGO 2025 from 31 March-3 April to hear more from Stuart Nicholls (Strike Energy), Brett Woods (Beach Energy), Dani Alexander (University of NSW Energy Institute) and a host of other domestic gas leaders. Learn more.

To access the detailed conference program, download the brochure here.